State Agency Guidance on CACFP Emergency Funds

Why it Matters?

During the early months of the pandemic due to COVID-19 related restrictions and closures, program operators experienced widespread and significant gaps in funding, and in many cases were forced to expend their savings, draw funds from other sources, and cut or even suspend operations. The relief provided by these reimbursements is intended to help address such shortfalls and ensure the program operators are in the best position to rebuild while continuing to serve their communities.

Summary:

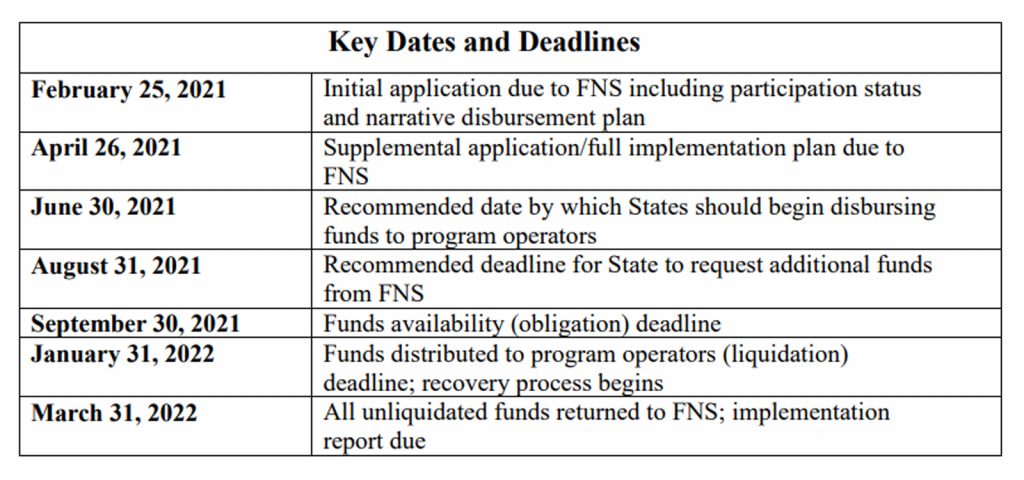

The Food and Nutrition Service (FNS) is offering additional funds to State agencies administering the National School Lunch Program (NSLP), School Breakfast Program (SBP), and the Child and Adult Care Food Program (CACFP) to provide local operators of those programs with additional reimbursements for emergency operating costs they incurred during the public health emergency. These additional funds will be provided by way of two temporary reimbursement programs, the School Programs Emergency Operational Costs Reimbursement Program and Child and Adult Care Food Program Emergency Operational Costs Reimbursement Program. To participate in these reimbursement programs State agencies must opt in by submitting an application and implementation plan to FNS.

Which CACFP operators are eligible to receive payments under the CACFP Emergency Operational Cost Reimbursement Program?

Eligibility is limited to Institutions, day care homes and unaffiliated centers that have maintained their Child Nutrition Program participation by filing valid claims for any of the of the months of September – December 2020 or have provided assurance to the administering State agency that they will file a claim within the first 90 days after the end of the public health emergency. Any institution, day care homes and unaffiliated center may be eligible to receive payments. Institutions means sponsoring organization, child care center, at-risk afterschool care center, outside-of-school hours care center, emergency shelter, or adult care center which enters into an agreement with the State agency to assume final administrative and financial responsibility for Program operations.

Do payments for administrative funds to the sponsors of day care homes received under the CACFP reimbursement program count towards the 10% carryover threshold for administrative funds for such sponsoring organizations?

No, funds received under the CACFP Emergency Operational Costs Reimbursement Program are separate from regular program reimbursements. They may not be factored into a sponsoring organization’s denominator for carryover calculations at the end of FY2021.

What is the role of the state agency in calculating payments?

In order to ensure consistency, reduce error-risk, and minimize burden for local program operators, State agencies should directly calculate payment amounts for SFAs and CACFP institutions with which they hold an agreement. CACFP sponsoring organizations, in consultation with their State agencies as needed, will determine payments for their unaffiliated centers and day care homes.

What are the payment calculations for the CACFP Emergency Operational Cost Reimbursement Program based on?

Payment calculations are based on the type of institution or facility:

- Sponsoring organizations of centers; independent child care centers, at-risk afterschool care centers, outside-school-hours care centers, emergency shelters, or adult day care centers; or day care homes: CACFP meal reimbursements

- Sponsoring organizations of day care homes: CACFP Administrative funds

Payment (or Reimbursement) Calculation

The value of the payment provided to each eligible recipient for the reimbursement months of March, April, May and June 2020 must be calculated based on either the amount of the CACFP reimbursements earned by the recipients for meals and supplements served under the provisions of 7 CFP Part 226, or for day care home sponsoring organizations, the total amount of administrative funds received, during the same reference months in 2019. The total amount of the applicable CACFP reimbursements or administrative funds earned during the reimbursement month in 2020 is first subtracted from the total reimbursements or administrative funds earned during the reference month. The difference between the two figures is then multiplied by the factor of .55 (55%) to arrive at the month's payment amount. [Payment for March is ½]

Example Calculation for April, May, June:

April 2020 payment = April 2019 reimbursement amount – April 2020 reimbursement amount) x .55

Example Calculation for March:

March 2020 payment = ((March 2019 reimbursement amount - March 2020 reimbursement amount) x .55) / 2

If an institution, day care home, or unaffiliated center was a new program operator in 2020, and therefore, not operating CACFP in 2019, the payment calculation employs an alternative reference period. The reimbursement is based on the average amount for the reimbursements earned by the new program operator in January 2020 and February 2020.

Example Calculation for April, May and June (new operators):

April 2020 payment = (Average of January and February 2020 reimbursement amount – April 2020 reimbursement amount) x .55

Example Calculation for March (new operators):

March 2020 payment = ((Average of January and February 2020 reimbursement amount – March 2020 reimbursement amount) x .55) / 2

What are the allowable uses of these funds at the program operator level?

The funds may be used to reimburse any local source of funds used to supplement the Nonprofit Food Service account during the reimbursement period to offset the impact of pandemic operations on that account. Any remaining funds must be deposited in the Nonprofit Food Service account and be used in accordance with normal program requirements.

How will payments be made to sponsored CACFP facilities?

Affiliated centers: Payment will be provided directly to sponsoring organizations for distribution to their facilities.

Unaffiliated centers: Sponsoring organizations must calculate and provide individual payments for their unaffiliated centers using the same formula outlined in the Q&A (see Q&A). The sponsoring organization may retain up to 15% of the payment to cover administrative expenses, subject to the agreement between the sponsoring organization and the unaffiliated center.

Day care homes: Sponsoring organizations must calculate and provide individual payments for their day care homes based on the formula outlined in the Q&A (see Q&A).

CACFP 05-2021